Looking back, the early days of freelancing were a financial rollercoaster for me. Money flowed in, money flowed out, and I had no clue where it was headed. Plus, the tax surprise hit hard one year, catching me completely off guard. I was essentially winging it. Mind you, I kicked off my business at 19, I was still a baby.

Now, with over 15 years under my freelance belt (and a few hard-earned lessons), I’ve finally found a system that works. One that brings peace of mind and a whole lot more stability. If you’re still trying to figure out how to manage your freelance money without feeling like you’re walking a financial tightrope, this one’s for you.

Money management for freelancers

When that beautiful payment hits your account, don’t make the rookie mistake I once did and treat it like a shopping spree ticket. Managing your money as a freelancer is a balancing act, and the best way to stay steady is to give every euro, pound, or dollar a job.

Paid invoice

Let’s say you’ve just finished a job and your invoice of $/£/€ 1000 (pick any currency that fits your income) has been paid into your business account. You want to make sure you trickle down this paid invoice into different accounts.

Set aside your tax first

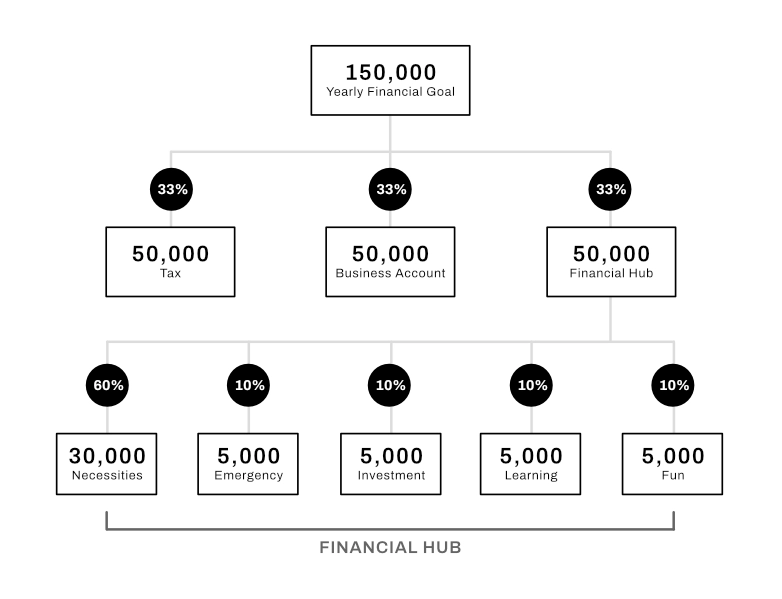

First off, squirrel away 33% for those inevitable taxes. That way, you’re safe when the government comes knocking at your door. Future you will be so grateful come tax season.

Business Account

Next up, business expenses. This can be subscriptions for software, hosting, phone and internet bills, etc…But you also have a marketing budget to think about, equipment for your work and so on. So, another third of your paid invoice stays in your business account to keep your studio humming.

Financial Hub

Finally, the last 33% heads to your Financial Hub, your spending money. But wait, there are still some pit stops before you’re buying rounds for everyone!

Money Management

Break your personal share into smaller buckets

Let’s talk about what happens inside that final 33%. Here’s how I split it to make sure my personal life is as sorted as my projects

Necessities

Necessities are basically your monthly must-haves. These recurring expenses often constitute a significant portion of your income.

- Rent or Mortgage

- Car or other transportation

- Insurances

- Utility bills

- Loans and Debt

- Telephone and Internet

- Groceries

- Etc.

Emergency

Stashing money for emergencies is a smart move. Whether your computer calls it quits or you need a new phone, having a financial cushion eliminates unnecessary stress.

I also strongly advise maintaining a reserve equivalent to at least 6 months’ worth of your “Necessities” total in this account. This ensures you’re covered for a substantial period in case of unforeseen events. If you can set aside more, it’s even better.

Investment

This could be a high-yield savings account, index funds, real estate… whatever fits your comfort level and goals. But always invest something, even if it’s small.

Learning

Keep the learning flame alive! Improving yourself requires setting aside time and resources. Consider investing in courses to acquire new skills or refine existing ones, both personally and professionally.

Fun

Finally, here’s your fun account—dedicated solely to you. It’s the space for all the enjoyable things on your wishlist.

Many freelancers might see a 1000 income as a green light to spend it all on fun. However, relying solely on this mindset can lead to significant challenges in the long run. And I get it, I really do. After all the hustle you’ve poured into your 1000 project, ending up with a modest 33 for your personal fun fund might not feel like a victory lap. But trust me, once you get control over your money, the peace of mind is worth more than another pair of shoes.

Create your financial goals

With a structure in place, you can start planning ahead, real goals, not wishful thinking. You’ll know exactly how much you need to make to support the life you want.

Financial Goal Example

Imagine your yearly necessities are around 30k. If one-third of your income goes to your Financial Hub and another third to your necessities, you’d need to earn approximately 150k a year to cover all your bills. Break this down into a monthly goal, and you’re looking at around 2,5k per month.

Adopting clear financial goals will:

- Keeps you motivated to earn more, giving you a specific target

- Enhances the likelihood of a comfortable future

- Aids in reducing or eliminating debt

- Facilitates saving for emergency situations

- Supports business growth

- Encourages investments for the future

- Creates better intentional choices about how you spend your money

- Reduces the chance of stressful financial situations

Additional wisdom on how to manage money

Ditch credit cards for debit cards

Let’s talk cold, hard numbers for a moment. The International Monetary Fund‘s stats are showing us that we’re drowning in debt. Just look at the U.S., where the credit card balance hit a jaw-dropping $1.079 trillion in Q3 2023, as per the Federal Reserve Bank of New York. It’s mind-boggling. We all know that those plastic cards fuel unnecessary extra spending, often on things we probably don’t need. Here’s a suggestion: live within your means. If you can’t afford it, don’t do it. If you lost track of life’s essentials, maybe minimalism can give you some answers. But trust me; letting debt take the wheel is a one-way ticket to a financial nightmare. My advice? Stick to debit cards if you’re serious about securing your financial future.

Live on less than you earn

Humans have another quirky habit of playing a game called “Let’s Spend It All” when they get their hands on some cash. It’s like, “Oh, we’ve got €2000? Challenge accepted, let’s spend every penny!” The more we earn, the more we feel we can afford, leading to increased spending. However, this doesn’t have to be the default behavior. Before parting with your hard-earned cash, it’s essential to consider the desired outcome and question whether the expenditure is truly necessary. Ask yourself, “Do I really need to make it rain cash right now?” Understanding how money can serve you and adopting a thoughtful approach can help redirect funds to more meaningful purposes. Instead of spending just for the sake of it, redirect those funds to your savings, investments, or a learning account. This way, your money works for you with purpose and intention.

Don’t follow any financial advise blindly

When you delve into online financial advice, you might stumble upon the 50/30/20 rule. It suggests allocating 50% to needs, 30% to wants, and 20% to savings. Another one is the 70/20/10 rule: which involves putting 70% of your earnings to living expenses, 20% to savings and 10% to debt or charity.

Never take financial advice on how to manage money as gospel. Take a moment to reflect on your professional and personal goals. Question how the advice aligns with what you want to achieve. Remember, there’s no one-size-fits-all rule when it comes to managing your money. It’s all about what works best for you.

This means, don’t follow my approach to a T either. Feel free to tweak the percentages and make it your own. The key is to maintain those allocation “buckets,” and if I were to throw in a tip, consider letting the Fun bucket be the last one you fill.

Conclusion

Learning how to manage money like a pro is about being intentional. It’s about making your money work for you instead of always chasing more of it. You don’t need to be a spreadsheet wizard. You just need a plan, some patience, and the willingness to say no to short-term indulgences so you can say yes to long-term freedom. The freelance life is already unpredictable. Your finances don’t have to be.